How To Buy a Home Without Waiting for Lower Rates

webadmin • February 24, 2025

You’re not alone if you’re hoping mortgage rates will drop before buying a home. But will they? According to expert forecasts, rates are expected to decline—but not as much as many buyers were hoping for.

The good news? Even if rates don’t drop significantly, you still have options to make homeownership more affordable.

The good news? Even if rates don’t drop significantly, you still have options to make homeownership more affordable.

How Much Will Rates Drop?

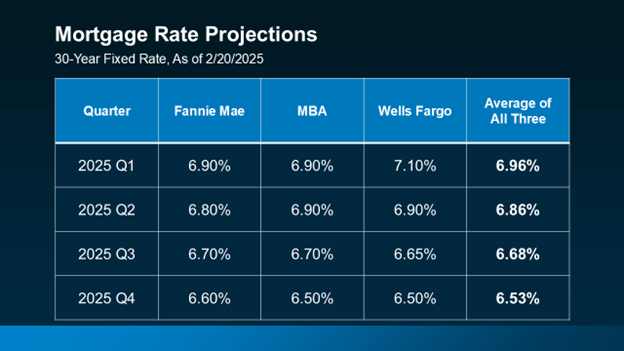

A few months ago, experts predicted mortgage rates could dip below 6% by the end of the year. But recent projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo suggest rates will likely settle between 6.5% and 7% instead (see below).

If you’ve been waiting for a dramatic drop before making a move, you may be waiting a while. And if life changes—like a new job, a growing family, or a major move—are pushing you toward homeownership now, waiting might not be an option.

Smart Financing Strategies for Today’s Market

Since rates may not dip as much as expected, it’s worth considering alternative financing options to make homeownership more affordable now. Here are three strategies you could explore with Luminate Bank:1. Mortgage Buydowns

A mortgage buydown lets you pay upfront to lower your interest rate for a set period, helping reduce your monthly payment early on. In fact, 27% of real estate agents say first-time homebuyers are increasingly negotiating buydowns with sellers to make purchasing more affordable.2. Adjustable-Rate Mortgages (ARMs)

ARMs typically start with a lower rate than a traditional 30-year fixed mortgage, making them an attractive option—especially if you plan to refinance later when rates drop. And if you’re wary because of the 2008 housing crash, rest assured: today’s ARMs are different. Back then, lenders approved buyers based on the initial low rate, sometimes without verifying income (remember those risky "Ninja loans”?). Now, lenders ensure borrowers qualify based on the highest possible payment, reducing the risks associated with ARMs.3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing loan—including their lower mortgage rate. With over 11 million homes qualifying for this option, according to U.S. News, this could be a game-changer if you’re looking for a more affordable rate.The Bottom Line

Waiting for mortgage rates to drop significantly may not be the best strategy. Instead, options like buydowns, ARMs, and assumable mortgages can help you buy a home now—without waiting on the market. Want to explore the best financing strategy for your situation? Connect with us today to find the right fit for you.

By webadmin

•

March 27, 2025

Spring kicks off real estate’s busiest season. As more homebuyers enter the market, the competition ramps up—so being prepared from the start gives you a real advantage. If you’re planning to buy a home this spring, getting pre-approved for a mortgage before you start shopping can help you stand out and move fast when it counts.

By webadmin

•

March 12, 2025

Can I really afford this? What if something breaks? What if my job situation changes? First things first: take a deep breath. Every first-time homebuyer has these thoughts. It’s part of the process. The key is to focus on what you can control and set yourself up for success. Here’s how.

By webadmin

•

February 27, 2025

Spring is bringing a fresh wave of home listings—finally! If you’ve been searching for the right home, this season could be your best chance yet. But what about affordability? With mortgage rates still hovering higher than expected, many buyers are wondering—should I jump in now or keep waiting?